Fiscal Year Adjustment and Currency Conversion

Overview

Fiscal Year Adjustment

This function creates a new Ledger Type (previous data will be stored and labeled Ledger Type 1) and adjusts Fiscal Year and Ledger Currency values for consolidate reporting. Adjusting your Fiscal Year also shifts your Account Balances and adjusts your retained earnings based on your Close to Account and the Opening Balance of your Income Statement accounts reverts to zero for your new Fiscal Year.

Currency Conversion

The currency conversion feature takes your original Ledger Currency and your new Ledger Currency (assigned to your Company in the Setup Table) and uses them to generate an exchange rate of 1 for all fiscal years created in your ERP that were loaded in your DimTime cube.

Please note that there are 2 types of exchange rates—closing rates and average rates.

Closing rates are applied to Ending Balances

Average rates are applied to the Posting, YTDs and Rolling 12s

Prerequisites

Fiscal Year Adjustment and Currency Conversion Prerequisites

- A loaded UDM DimTime cube

- A loaded UDM DimCompany cube

- A loaded UDM Accounts cube

- A loaded UDM Finance Staging cube

Fiscal Year Adjustment Exclusive Prerequisites

- A 12-period Fiscal Year

- A Fiscal Period that starts and ends with a calendar month

You can use the currency conversion feature even if you do not meet the fiscal year adjustment prerequisites, however, please ensure that you do not change the First Period value of your Fiscal Year.

Process

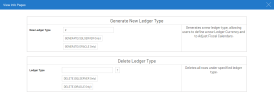

- In the Data Models and Views menu, expand Universal Data Model followed by Finance and Configuration. Then, right-click on the Ledger Type Creation data model and choose View Info Pages (shown below). Then, select any New Ledger Type other than 1 or any existing Ledger Type and click Generate.

- Now, open the Ledger Type Setup worksheet (inside Ledger Type Creation as well) and enter a new First Period and Ledger Currency value. Please note that in this context, calendar months are represented by their ordinal numeric equivalent (e.g., January = 1, February = 2, etc.)

Here the company NA10 has chosen a Period 1 value of January for Ledger Type 2, whereas, it was originally March in Ledger Type 1.

- Once the new Ledger Currency and Fiscal Period have been set, open the Calendar Preview worksheet (shown below) to review your changes.

You may wish to add a Year Adjustment value if your Fiscal Calendar appears to be incorrect. For example, say that you changed the First Fiscal Period value from January to December, and now December 2020 is appearing as 2020-01 (i.e., the first period of the 2020 Fiscal Year) but you intended for it to be 2021-01. Adding a Year Adjustment value of 1 would resolve that issue.

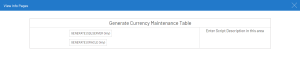

- When you have confirmed that the changes to your calendar are correct, find and expand Currency Rate Maintenance (in Configurations) then, right-click on the Currency Rate Maintenance worksheet and select View Info Pages. Click Generate to generate the exchange rates.

Using the Currency Rate Maintenance Info Page will not generate any exchange rates if no changes were made to the Ledger Currency.

- Now, open the Currency Rate Maintenance worksheet (shown below) and make any desired changes to the rates.

- When you are finished, activate all Data Sources containing a New Ledger and reload the Finance Cube.

Ledger 1

Period 1: March

Posting: -341,744

Ledger 2

Period 1: January

Period 3: March

Average Exchange Rate: 1.30, -341.744*1.3 = -444,267.2